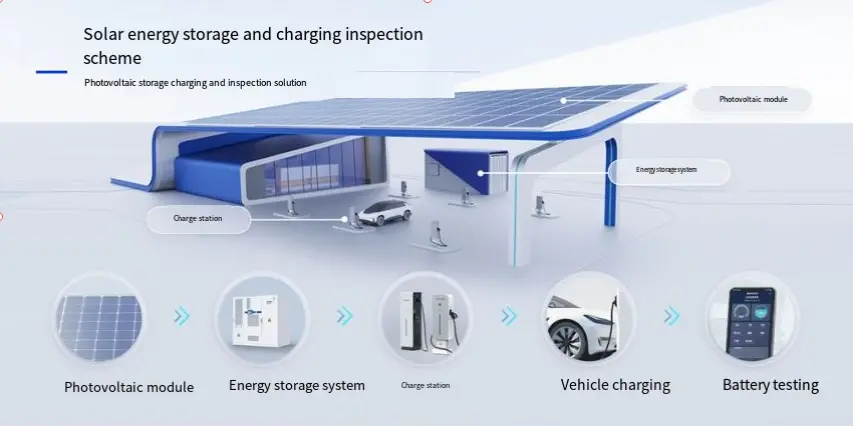

Market Layout Analysis for PV + Energy Storage + EV Charging (PV-Storage-Charging)

1. Market Overview

China stands as a global leader in PV-storage-charging solutions, with a rapidly expanding market fueled by the integration of renewable energy and electric vehicle (EV) infrastructure.

The charging infrastructure in China is experiencing rapid growth. The stock of EV charging piles has exceeded 6 million units, and the market continues to expand at double-digit rates.

Energy storage capacity is on the rise, bolstered by national and local policies that enhance the economic viability of integrated PV-storage-charging stations.

2. Key Growth Drivers

- Rising EV Penetration: The increasing number of EVs and the demand for ultra-fast charging necessitate a stable, high-capacity power supply. PV + storage systems alleviate grid strain and reduce peak electricity purchases.

- Policy Incentives: Government subsidies, tax breaks, and favorable grid regulations accelerate the deployment of PV-storage-charging projects.

- Technology & Cost Trends: Declining costs of PV modules and batteries, flexible storage durations (1–8 hours), and innovative business models like Energy-as-a-Service (EaaS) enhance project feasibility.

3. Market Segmentation & Deployment Scenarios

High-Priority (Fast Payback)

- Urban public fast-charging hubs in malls, office areas, or large parking lots, paired with rooftop/ground PV and short-duration storage (1–4 hours).

Medium-Priority (Scalable)

- Highway service areas and retrofitted fuel stations with high-power charging and PV generation for daytime peak shaving.

Long-Term (Strategic)

- Fleet charging stations for logistics or public transport, potentially combined with mobile/shared storage, Vehicle-to-Grid (V2G), and carbon credit trading.

4. Industry Chain & Key Players

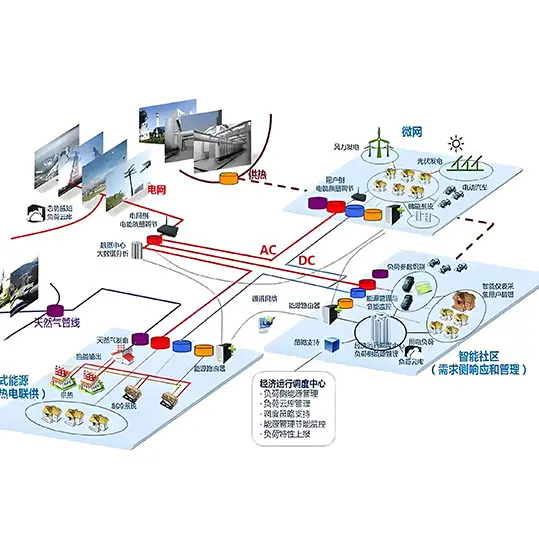

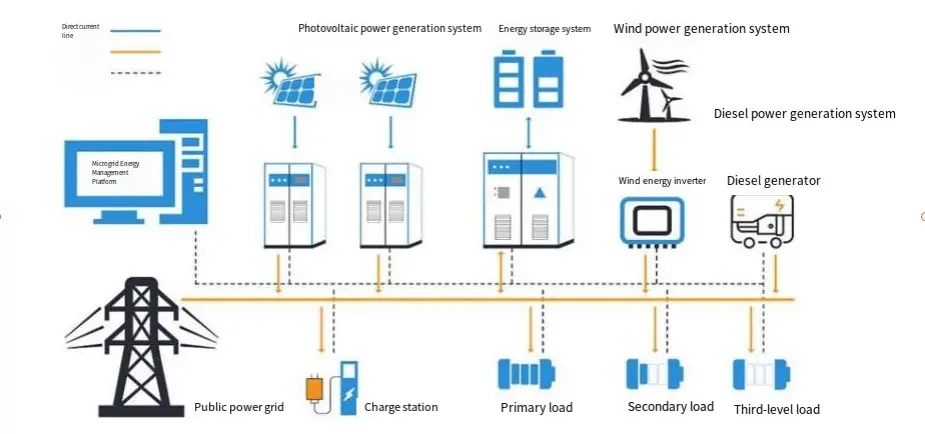

- Upstream: PV modules, inverters, battery cells & PACK, Battery Management System (BMS).

- Midstream: Energy storage Power Conversion System (PCS), charging pile modules, Energy Management System (EMS) software.

- Downstream: Engineering, Procurement, and Construction (EPC) integrators, operators, energy trading platforms.

Strong integration capabilities, combining PV, storage, charging, and EMS, will provide a competitive edge.

5. Opportunities & Risks

Opportunities

- Early deployment in policy-friendly regions secures a market position.

- Offering turnkey station solutions allows for higher engineering and Operations & Maintenance (O&M) margins.

Risks

- Regulatory changes in grid connection and technical standards may necessitate design updates.

- Electricity pricing fluctuations could impact profitability.

- High upfront Capital Expenditure (CAPEX) requires robust financing or long-term contracts to ensure returns.

6. Recommended Business Models

- Self-Build & Operate: Suitable for fleet operators, logistics parks, or property developers.

- Energy-as-a-Service (EaaS): Zero-CAPEX for the client, with the operator investing and charging per kWh or service fee.

- Power Purchase Agreements (PPA) + Grid Services: Sell green electricity while participating in energy markets for additional revenue.

7. Deployment Roadmap

Phase 0 – Pre-Study (0–1 Month)

- Select 2–3 pilot sites.

- Assess load profiles, solar resource potential, and grid access capacity.

Phase 1 – Pilot Deployment (1–6 Months)

- Configure PV capacity (kW), storage size (kWh), and charging type (slow/fast/ultra-fast).

- Secure partners for PCS, BMS, EMS, and charging modules.

- Choose a financing model (EaaS, Build-Operate-Transfer (BOT), or hybrid).

Phase 2 – Scale-Up (6–24 Months)

- Use Key Performance Indicator (KPI) results from pilots (pile utilization, self-consumption rate, peak shaving effect, Internal Rate of Return (IRR)) to refine business models.

- Replicate to similar sites and offer turnkey integrated solutions.

8. Key Technical & Financial KPIs

- Storage Duration: Match to charging demand (short for fast-charging, longer for peak management).

- Self-Consumption Rate: Higher PV direct-use rate improves economics.

- Pile Utilization Rate and Equipment Availability: Maintain >99%.

- EMS Capabilities: Real-time power dispatch and grid/market interaction for extra revenue streams.

9. Strategic Recommendations

- Launch 1–2 commercial pilot sites in regions with easy grid access and strong subsidies.

- Build in-house or partnered integration capability for PV-storage-charging turnkey delivery.

- Engage local governments and energy companies for pilot status and preferential policies.

10. Quick Execution Checklist

- Site Survey Template: Include load profile, grid connection point, available PV area.

- Local Subsidy and Incentive Database: Stay updated on available financial support.

- Shortlist of Suppliers: Identify reliable providers for PV, PCS/BMS, charging modules, EMS.

- Pilot KPIs & 12-Month Risk Mitigation Plan: Establish clear metrics and contingency strategies.

Keywords: PV-Storage-Charging Market, EV Charging Infrastructure, Renewable Energy Integration, Energy Storage Solutions, Business Models for PV-Storage-Charging