China’s Industrial and Commercial Energy Storage Market: Investment and Financing Logic Amid Global Energy Transition

Market Overview

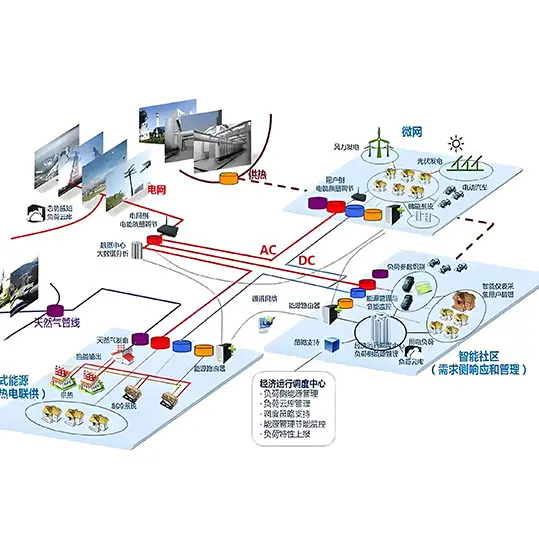

As the global energy transition accelerates, new energy storage technologies emerge as a pivotal solution to renewable energy intermittency and a means to enhance energy efficiency. In China, industrial and commercial energy storage, a vital segment of the energy storage market, exhibits distinct characteristics and trends in its investment and financing landscape.

Rapid Market Development

In recent years, China’s industrial and commercial energy storage market has witnessed rapid growth. With the gradual implementation of peak-valley electricity price differential policies and the continuous improvement of the power market, industrial and commercial users increasingly install energy storage systems for peak shaving, valley filling, and electricity cost reduction. This trend is particularly pronounced in economically developed regions with high electricity consumption, where the market potential remains enormous. According to public data, in the first half of 2024, China witnessed over 4,200 filed industrial and commercial energy storage projects, totaling 6.2GW/14.7GWh with investments exceeding 24 billion yuan. This indicates a period of rapid growth, attracting significant capital and enterprise attention.

Core Elements of Investment and Financing Logic

Policy Guidance and Support

Policy plays a crucial role in guiding the development of the industrial and commercial energy storage market. The Chinese government has introduced a series of supportive policies, including peak-valley electricity price differential policies, power spot market construction, and energy storage project subsidies. These policies create a favorable environment and economic incentives for market development. For instance, local governments have adjusted time-of-use electricity pricing to widen peak-valley differentials, enabling industrial and commercial users to achieve arbitrage through energy storage system installation. Additionally, subsidies and tax incentives reduce investment costs and enhance project economic viability.

Market Demand and Economic Benefits

Market demand serves as a key driver for investment and financing in industrial and commercial energy storage projects. With rising electricity costs and an improving power market, demand for energy storage systems among industrial and commercial users continues to grow. Installing these systems offers multiple benefits, including peak shaving, valley filling, cost reduction, and energy efficiency improvement. Economic benefits primarily derive from peak-valley arbitrage, demand-side response, and load management. In regions with significant peak-valley differentials, such as Guangdong and Zhejiang, the equivalent price differential for two daily charge-discharge cycles exceeds 1.2 yuan/kWh, yielding a theoretical IRR exceeding 15% and indicating excellent investment returns.

Technological Maturity and Cost Reduction

Technological maturity and cost reduction significantly drive market development. Recent advancements in energy storage technologies, coupled with ongoing cost reductions, have substantially improved the performance and economic viability of industrial and commercial energy storage systems. Key technologies, including energy storage batteries, PCS (bidirectional converters), and EMS (energy management systems), have enhanced system efficiency, safety, and reliability. Meanwhile, scale effects and supply chain optimization continue to drive down costs. Predictions indicate that by 2025, the average price of industrial and commercial energy storage systems will drop from the current 0.7 yuan/Wh to below 0.6 yuan/Wh, further enhancing project economic viability.

Investment Models and Risk Management

Investment models for industrial and commercial energy storage projects primarily include Energy Performance Contracting (EMC), owner investment, and pure leasing. The EMC model dominates, where a third-party investor handles investment, construction, and operation, while the user provides space and transformers and shares profits according to an agreed ratio. This model reduces user investment risk and enhances project replicability and scalability. In terms of risk management, investors must monitor policy changes, market demand fluctuations, and technological updates. By strengthening market research, policy studies, and technological innovation, investors can effectively mitigate project risks and improve investment returns.

Future Outlook

Looking ahead, technological advancements and ongoing cost reductions will further enhance the performance and economic viability of industrial and commercial energy storage systems. Simultaneously, the government will continue to introduce supportive policies to promote rapid industry development. Investors should closely monitor market dynamics and policy changes, actively seize investment opportunities, and drive the prosperity and development of the industrial and commercial energy storage market.

Keywords: Industrial and Commercial Energy Storage, Investment and Financing Logic, Market Development, Policy Support, Economic Benefits, Technological Maturity, Cost Reduction, Investment Models, Risk Management